This article aims to provide educational content and is not intended as investment advice.

Cryptocurrencies have transcended beyond being a speculative asset or just digital currencies. They represent a foundational shift in how we interact with the global financial system. The promises of cryptocurrencies go beyond investment opportunities; they offer a vision of a more empowered and connected world. As this new asset class burgeons, many potential investors and users wonder how they can reap the benefits that cryptocurrencies offer. Here’s how you can benefit from the fundamental aspects of cryptocurrencies.

Decentralization: Financial Autonomy Redefined

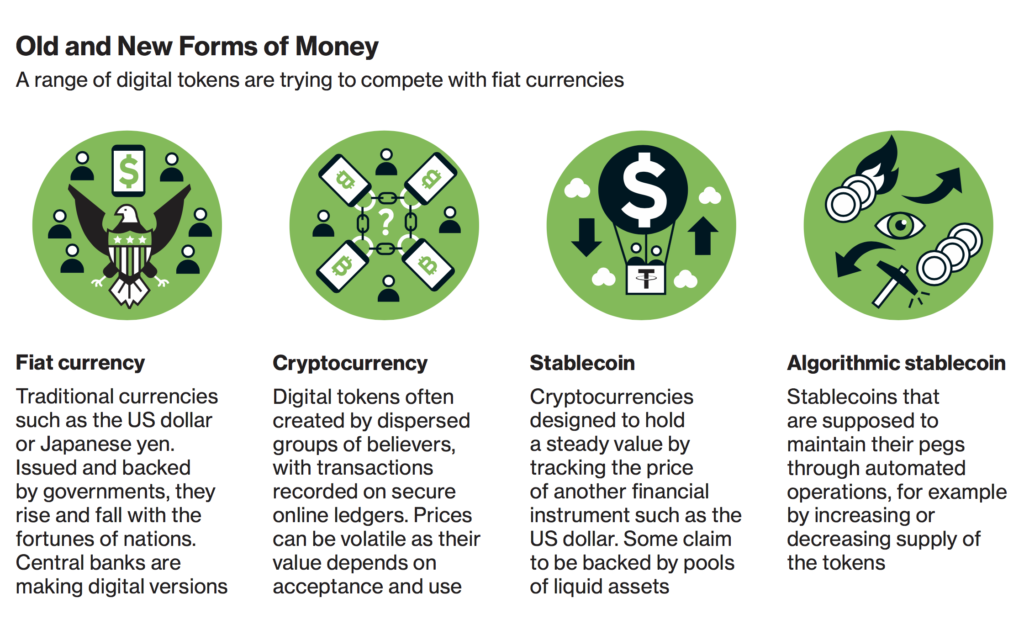

Decentralization is the heartbeat of cryptocurrency. Unlike traditional currencies controlled by banks and governments, cryptocurrencies are governed by a distributed network of computers, also known as nodes. This revolutionary model places power back into the hands of individuals, ensuring that users have control over their financial transactions without oversight from a central authority.

Empowering Individuals: In a decentralized system, you become the sole custodian of your wealth. This shift reduces the dependency on institutions and removes the risk of censorship. In regions where the political landscape may be unstable, cryptocurrencies offer a sanctuary for assets, protecting them from devaluation.

How to Leverage: Use cryptocurrencies for direct peer-to-peer transactions to sidestep bank fees, or consider adopting digital assets as a store of value in economies suffering from hyperinflation. The empowerment provided by cryptocurrencies can be particularly transformative in regions where financial infrastructure is limited or where political instability threatens traditional banking.

Transparency and Immutability: Fostering Trust Through Technology

Blockchain, the technology behind cryptocurrencies, is a testament to transparency and security. Each transaction is recorded on a digital ledger, accessible to anyone, ensuring that the movement of assets is traceable and permanent. This level of transparency is unprecedented in the financial world, where transactions have traditionally been shrouded in secrecy.

Building Trust: In business, transparency can build immense trust between parties. When transactions are recorded on a blockchain, they become irreversible, meaning that once a commitment is made, it cannot be undone. This feature is invaluable for contracts and agreements, where trust is paramount.

How to Leverage: Leverage the immutability of blockchain transactions to enhance the integrity of business operations. For example, use smart contracts to enforce agreements in trade deals automatically. The clear audit trail provided by blockchain can also streamline record-keeping, making it easier to track assets and verify transactions.

Inclusivity and Accessibility: Banking the Unbanked

Cryptocurrencies open the doors of financial services to everyone with internet access. By removing the need for traditional banking infrastructure, they offer financial inclusivity to the estimated 1.7 billion unbanked adults worldwide.

Broadening Horizons: Cryptocurrencies can serve as a bridge to financial inclusion, offering a variety of financial services such as savings, loans, and insurance to those traditionally excluded from the financial system.

How to Leverage: If you reside in an area with limited banking services, cryptocurrencies can offer a viable alternative for managing and growing your wealth. They also present a chance for entrepreneurs to access global markets, where payment systems may have been a barrier previously.

Borderless Transactions: A World Without Financial Barriers

One of the most remarkable features of cryptocurrencies is their ability to transcend geographical boundaries. Sending money across the world can be as easy as sending an email, with no need for currency exchange or reliance on intermediaries.

Embracing Global Commerce: This borderless nature simplifies international trade and remittances, making it easier for individuals to connect and transact on a global scale.

How to Leverage: Utilize cryptocurrencies for overseas transactions to bypass the high fees and delays of traditional banking. This can be particularly beneficial for expatriates sending money home or businesses engaging in international trade.

Security: The Cryptographic Shield

Cryptocurrencies are fortified with advanced cryptography, making them incredibly secure. This level of security is a significant boon in an era where digital fraud and financial cyberattacks are rampant.

Enhancing Personal Security: The cryptographic protocols of cryptocurrencies protect users against fraud and unauthorized transactions, providing peace of mind for digital dealings.

How to Leverage: For personal use, ensure the safety of your cryptocurrency by employing hardware wallets for storage. For businesses, adopt blockchain technology to secure your supply chain, knowing that each entry on the blockchain is protected against tampering.

Programmability and Smart Contracts: Automation for Efficiency

The programmability of cryptocurrencies – particularly those that support smart contracts – allows for the automation of complex agreements and transactions. These self-executing contracts can trigger actions upon the fulfillment of predefined conditions, streamlining processes across various industries.

Revolutionizing Industries: From real estate to supply chain management, smart contracts can automate and enforce agreements, reducing the need for intermediaries and slashing associated costs and delays.

How to Leverage: Use smart contracts to automate business processes. For example, an escrow service can be programmed to release funds only when specific conditions are met, ensuring fairness in transactions without the need for a middleman.

Conclusion

Cryptocurrencies are more than a speculative asset; they are a beacon for a more connected, efficient, and fair financial future. By leveraging their core benefits – decentralization, transparency, inclusivity, borderless transactions, security, and programmability– cryptocurrencies have the potential to empower individuals and reshape the business world. Understanding and utilizing these aspects can lead to significant gains, not only in financial terms but in contributing to a more equitable world. Whether you’re an individual seeking to protect your wealth, a business aiming for global reach, or simply a believer in a fairer financial system, the transformative power of cryptocurrencies is open for you to harness.